when to expect unemployment tax break refund california

Up to 3 months. You will exclude up to 20400 from.

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

The federal tax code counts jobless benefits.

. This is the fourth round of refunds related to the unemployment compensation exclusion provision. If you both received 10200 for instance and qualify for the break you can subtract 20400 from your taxable income assuming your modified adjusted gross income is less than 150000. You will exclude up to 10200 from your federal AGI.

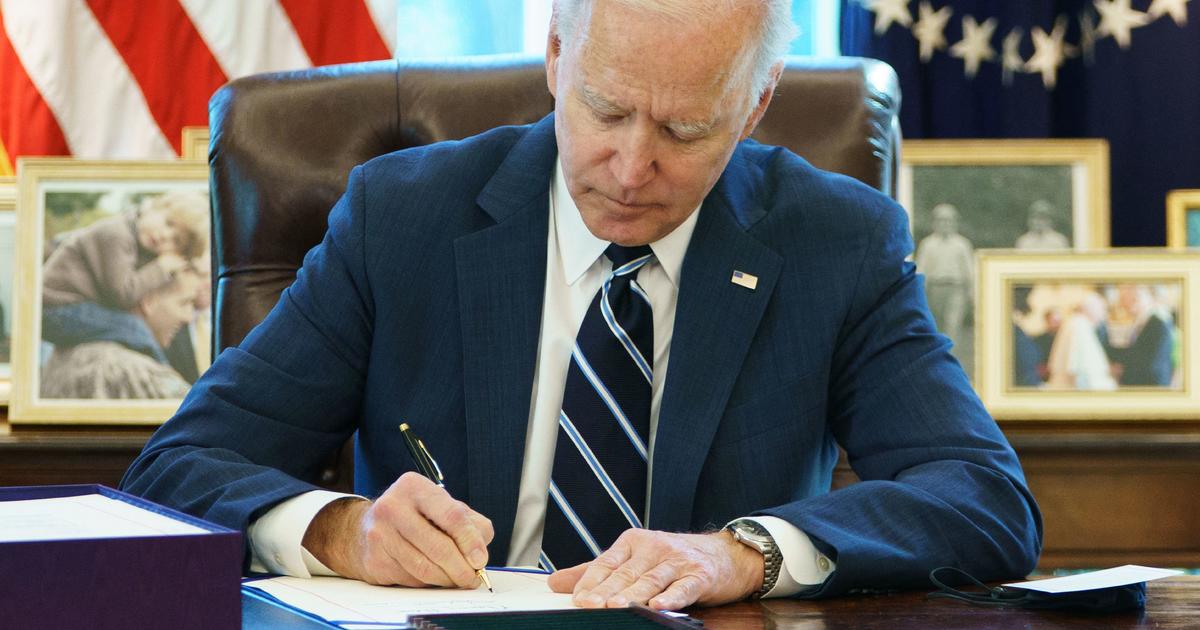

Visit Instructions for Schedule CA 540 7. Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud and identity theft. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Will there be a tax break for the unemployed in 2022. IRS tax refunds to start in May for 10200 unemployment tax break. Get your tax refund up to 5 days early.

22 2022 Published 742 am. Most should receive them within 21 days of when they file electronically if they choose direct deposit. A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for.

The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. The tax break is for those who earned less than 150000 inadjusted gross incomeand for unemployment insurance received during 2020At this stage. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

If you claimed. When Should I Expect My Tax Refund In 2022. 20400 for married taxpayers filing jointlyregistered domestic partners.

This is because unemployment benefits count as taxable income. The law allows taxpayers to exclude from income up to. The exclusion may affect a taxpayers.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor. The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021.

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify. When to expect unemployment tax break refund california. Another way is to check your tax transcript if you have an online account with the IRS.

Up to 10 cash back The American Rescue Plan Act of 2021 excludes up to the following amounts of unemployment compensation from federal AGI for 2020. I was told that my file was referred and expect a refund in 30 days. Up to 3 weeks.

Thankfully the IRS has a. Married filing jointlyregistered domestic partners. As such many missed out on claiming that unemployment tax break.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Tax season started Jan. New income calculation and unemployment.

24 and runs through April 18. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify. The IRS anticipates most taxpayers will receive refunds as in past years.

The tax waiver led to some confusion given it was announced in the middle of tax season prompting the IRS to offer additional guidance on how. Turbotax and hr block customers are facing delays accounting for a 10200 unemployment tax break. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund starting in May if you qualify.

How long it normally takes to receive a refund. The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your filing status. Tax break for Unemployment.

If you havent filed your 2020 tax return. If your mailing address is 1234 Main Street the numbers are 1234. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

By Anuradha Garg. The exclusion applies only if the taxpayers AGI for the tax year is less than 150000. Heres what you need to know.

COVID Tax Tip 2021-46 April 8 2021. MoreIRS tax refunds to start in May for 10200 unemployment tax break. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Where S My Refund California H R Block

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

10 200 In Unemployment Benefits Won T Be Taxed Leading To Confusion Amid Tax Filing Season Cbs News

When Will Irs Send Unemployment Tax Refunds 11alive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

When Will Irs Send Unemployment Tax Refunds Weareiowa Com

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployed Workers Could Get A Nasty Surprise At Tax Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog